New Delhi: Home-grown FMCG major Dabur has lowered the time of its strategic vision cycle from four years to three years aiming to create a more agile organisation amid a slowdown in the FMCG space and volatile geopolitical landscape.

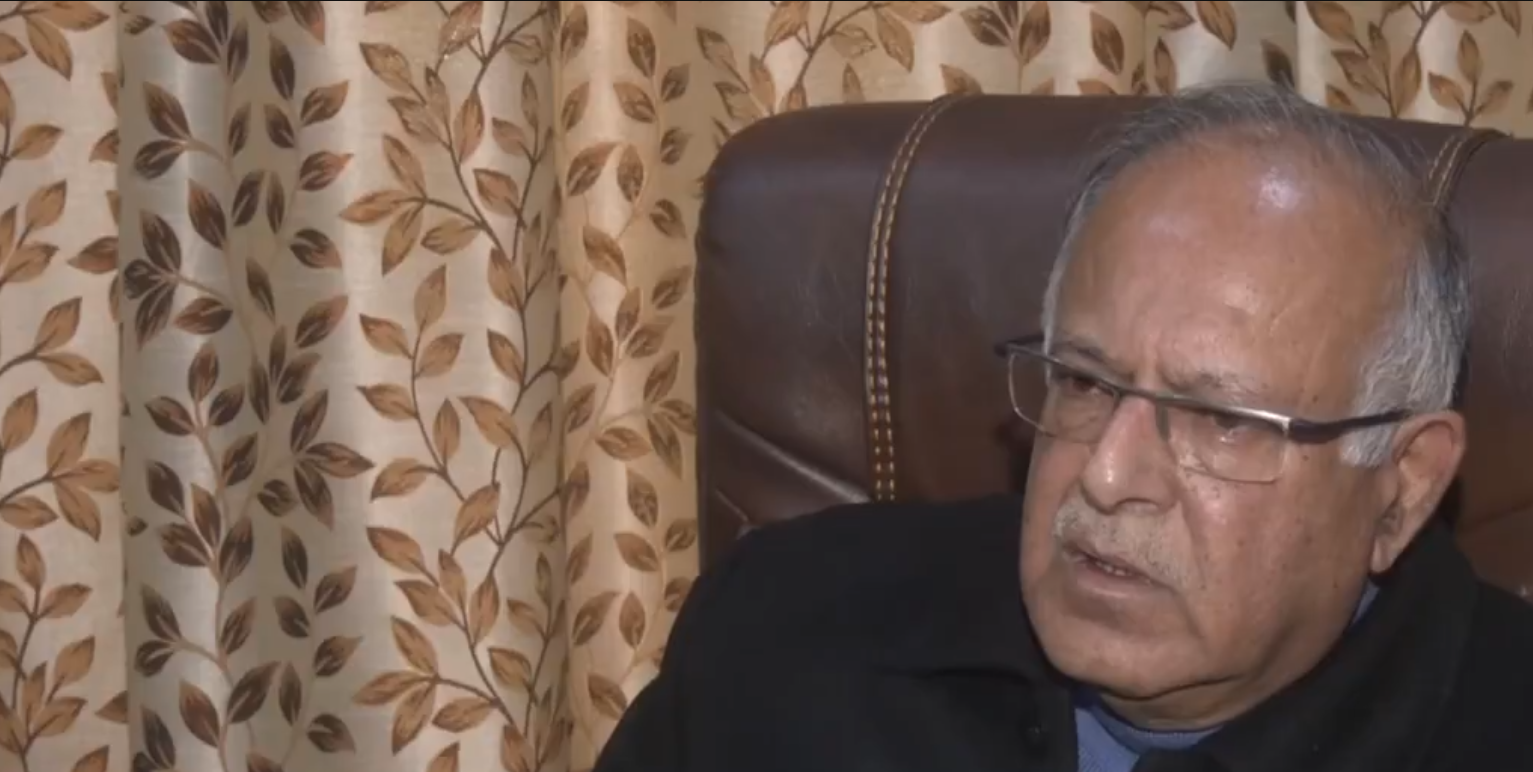

It has engaged consulting firm McKinsey & Co to refine and align its strategies for the next three years in line with the evolving dynamics, its CEO Mohit Malhotra said in an earnings call.

“This exercise has already begun, and we plan to conclude the same by the end of the fiscal year. This will enable us to capture emerging opportunities and navigate the future with sharper and more focused vision,” he said.

Dabur has four-year vision plans and is currently in the seventh vision cycle.

“Earlier we used to have a four-year vision cycle… We feel that in this volatile and heavy-headwind macroeconomic environment and FMCG not doing so well as a sector… we require a validation of our strategies through an external consultant,” he said.

Malhorta further said that by truncating a vision period from four years to three years, strategies can be taped up, fine-tuned, aligned, and quickly recalibrated.

“Four years becomes a longish period and therefore we have truncated it to three years, and it’s also in line with the best practice in the industry which is also around three years,” he said.

McKinsey in the vision exercise will do all the numbers, category reviews and validate all the strategies of the company, including Chyawanprash and beverages, etc.

“So, they will focus on that along with defining the numbers in the milestones for the next three years, and this vision exercise will dovetail into the next year budgeting cycle also for us,” he said, adding “at the moment, we have not linked them to our target achievement. But that is something that we will contemplate after this exercise is over.”

Malhotra further noted that the external consultant will debate and question all businesses which are non-performing or even performing, which have got a right to win for Dabur.

“Anything which does not have a right to win, they will be questioned and there will be a debate happening between the management and them to retain or to size down or to reduce investments… So, it will be a very strategic exercise that we are doing,” he said.

Dabur India has reported an increase of 1.85 per cent in consolidated net profit to Rs 515.82 crore in the December quarter and its revenue from operations was up 3 per cent to Rs 3,355.25 crore in the October-December quarter.

Dabur India owns brands such as – Dabur Amla, Dabur Vatika, Dabur Chyawanprash, Dabur Honey, Honitus, Pudin Hara and Dabur Lal Tail and juice brand Real.