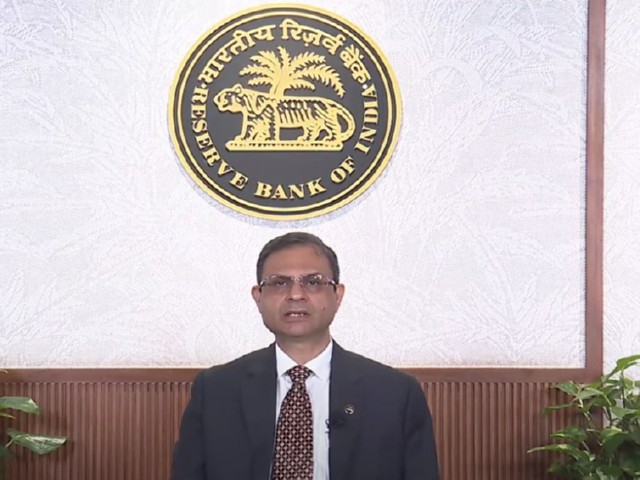

Mumbai: The Reserve Bank of India’s Monetary Policy Committee (MPC) has unanimously decided to keep the repo rate unchanged at 5.5% in its August policy meeting. The announcement was made by RBI Governor Sanjay Malhotra on Wednesday.

The MPC, which convened on August 4, 5, and 6, assessed the current economic and financial conditions before arriving at the decision. Governor Malhotra confirmed that all six members voted to maintain the repo rate under the Liquidity Adjustment Facility (LAF) at 5.5%.

“After a comprehensive evaluation of the evolving macroeconomic and financial landscape, the MPC unanimously agreed to hold the policy rate steady at 5.5%,” Malhotra stated.

The status quo follows a 50-basis-point rate cut in June, which brought the repo rate to its current level. That reduction was driven by easing inflation, which remains within the RBI’s comfort range. The Governor noted that softening food inflation has given the central bank additional policy space.

Retail inflation has continued to decline, hitting a six-year low. The Consumer Price Index (CPI)-based inflation for June was provisionally recorded at 2.10% year-on-year — a 72-basis-point drop from May 2025 and the lowest since January 2019.

Food inflation has also eased. The Consumer Food Price Index (CFPI) for June showed a provisional year-on-year rate of (-) 1.06%, with rural areas at (-) 0.92% and urban areas at (-) 1.22%.

Wholesale inflation turned negative as well. The Wholesale Price Index (WPI) for June was (-) 0.13%, down from 0.39% in May. The Ministry of Commerce and Industry attributed this to falling prices of food items, mineral oils, metals, crude petroleum, and natural gas.

Governor Malhotra expressed optimism about the economic outlook. “The monsoon is progressing well, and the upcoming festive season is expected to boost economic activity. Supported by government and RBI policies, these factors create a favourable environment for near-term growth,” he said.