Mumbai: The reconstituted rate-setting panel of the Reserve Bank on Monday started deliberations on the next bi-monthly monetary policy amid expectations of a status quo on interest rates in view of inflationary concerns and the possibility of a flare-up in the Middle East crisis that could jack up commodity prices.

In the current context, experts feel that the RBI may not follow the US Federal Reserve, which lowered the benchmark rates by 50 basis points, and the central banks of some developed nations, which have reduced the interest rates.

Earlier this month, the government reconstituted the Monetary Policy Committee (MPC).

It has appointed Ram Singh, Saugata Bhattacharya, and Nagesh Kumar as external members of the MPC. They have replaced Ashima Goyal, Shashanka Bhide, and Jayanth R Varma.

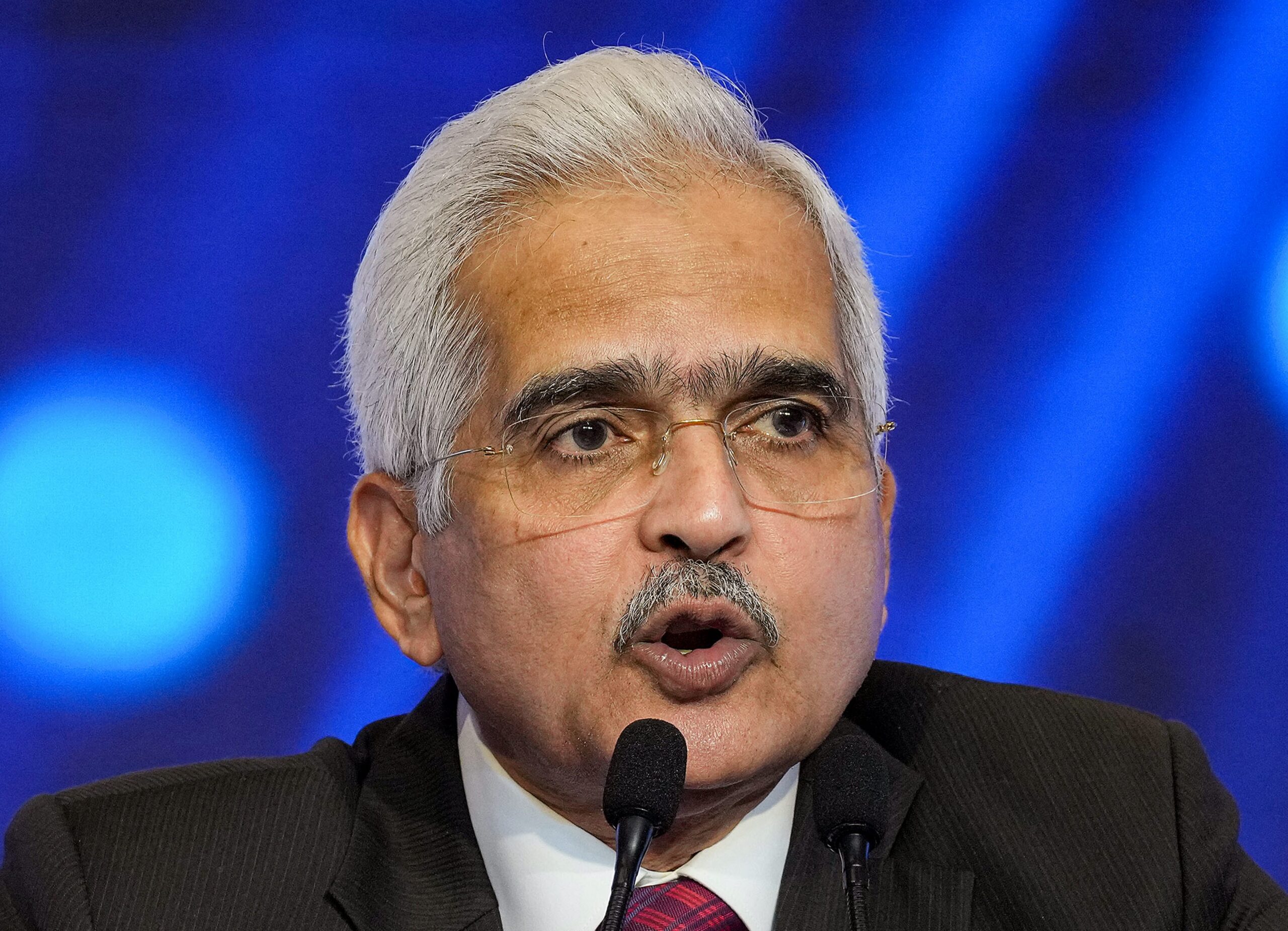

Apart from Governor Shaktikanta Das, the other internal members are the RBI Deputy Governor in charge of monetary policy Michael Debabrata Patra and the Executive Director monetary policy department of RBI Rajiv Ranjan.

MPC Chairman Das will reveal the outcome of the three-day discussion on Wednesday (October 9).

The central bank has kept the repo or short-term lending rate unchanged at 6.5 per cent since February 2023, and experts think some easing could only be possible in December.

The government has tasked the central bank to ensure that Consumer Price Index (CPI) based retail inflation remains at 4 per cent with a margin of 2 per cent on either side.

“We expect the RBI to keep the policy repo rate (currently at 6.50 per cent) and stance (withdrawal of accommodation) unchanged in the upcoming October monetary policy meeting, though we feel strongly that the stance should be changed to neutral, considering the change in global rates cycle and potential risks to India’s growth momentum going forward,” said Kaushik Das, chief economist, India & South Asia, Deutsche Bank.

The RBI is likely to keep its FY25 real GDP growth (7.2 per cent yoy) and CPI inflation (4.5 per cent yoy) forecasts unchanged in the October policy, though there could be changes made to the quarterly CPI forecasts, particularly for July-Sep’24, he added.

On expectations from the MPC, Radhika Rao, executive director and senior economist, DBS Bank said the central bank’s resolve in addressing food price inflation and preventing an un-anchoring in inflationary expectations is likely to see the MPC members lean towards a pause in October, with a softening in stance towards the December rate review.

“Geopolitics also warrant attention after the overnight escalation in tensions between Iran and Israel,” she added.

The central bank last hiked the repo rate to 6.5 per cent in February 2023 and since then, it has held the rate at the same level.

Dhruv Agarwala, Group CEO, Housing.com too expects the RBI to continue maintain status quo on the repo rate.

“Although inflation is largely aligned with the RBI’s 4 per cent target, estimates for September’s CPI stand at 5.2 per cent, a significant rise from August’s 3.7 per cent,” he said.

While the combination of slowing growth and declining inflation could pave the way for a rate cut starting in December, prospective homebuyers in India may need to wait a little longer before seeing further relief in borrowing costs, Agarwala added.

Ayush Lohia, CEO of Lohia, a manufacturer of electric three-wheelers (E3W) emphasised on the need for sustained policy backing to drive growth in the EV segment.

“I strongly urge access to low-interest loans or debt financing options to facilitate the adoption of E3Ws among consumers and fleet operators also we are looking for tax benefits or exemptions to make E3Ws more affordable for consumers and profitable for manufacturers,” he said.

By addressing these areas, Lohia said the RBI can help create a conducive environment for the growth of the E3W industry in India, aligning with Prime Minister’s vision to lead the affordability and sustainability drive in the electric vehicle industry

The RBI kept the repo rate unchanged at 6.5 per cent in its August bi-monthly review amid risks from higher food inflation.

In an off-cycle meeting in May 2022, the MPC raised the policy rate by 40 basis points and it was followed by rate hikes of varying sizes, in the subsequent meetings till February 2023. The repo rate was raised by 250 basis points cumulatively between May 2022 and February 2023.