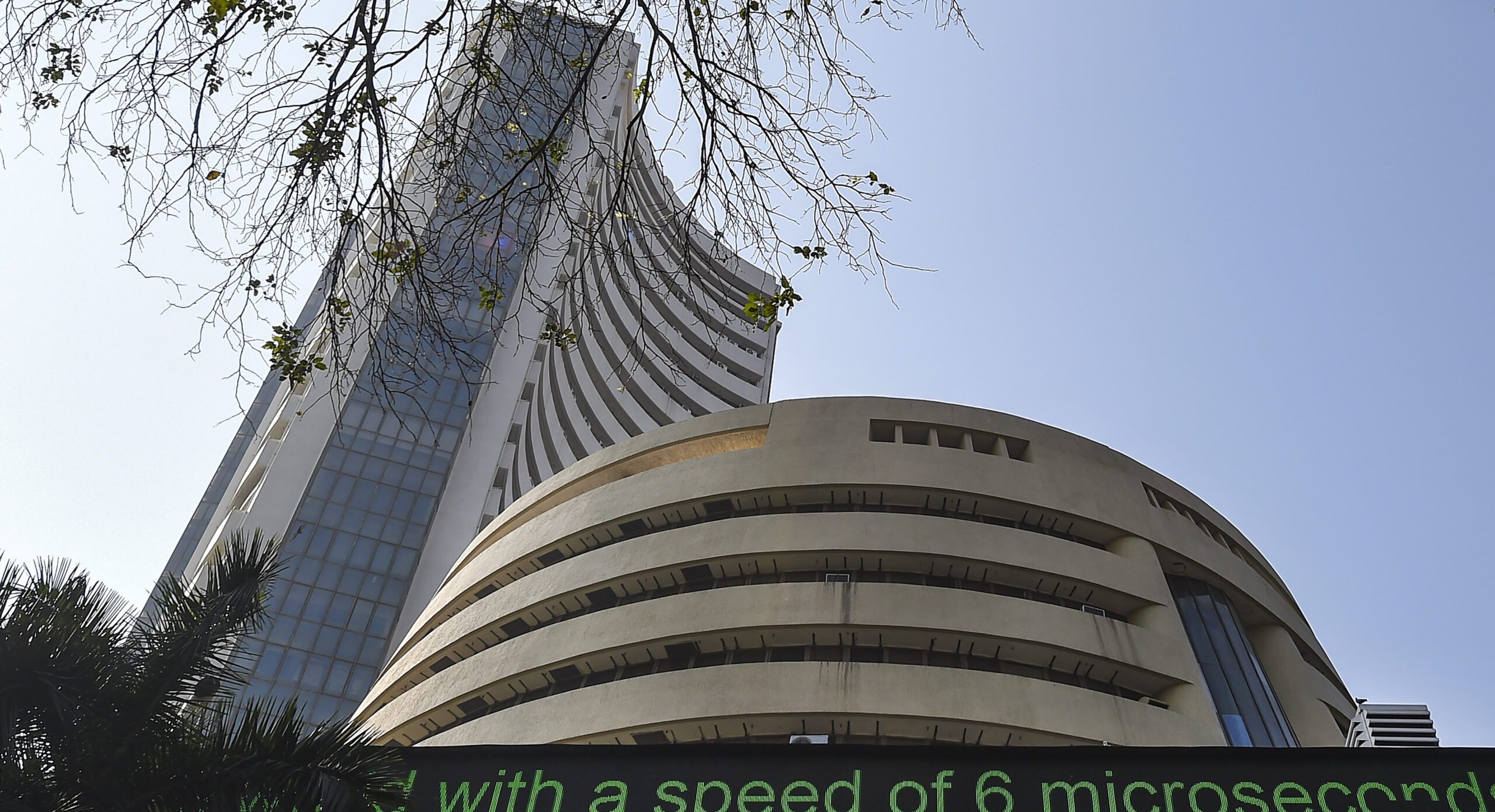

Mumbai: Equity benchmark indices Sensex and Nifty extended their losing streak for the sixth straight session and settled sharply lower on Monday dragged down by heavy selling in bellwether stocks amid mixed global trends and outflow of foreign funds.

The BSE Sensex tumbled 638.45 points or 0.78 per cent to settle at 81,050. During the day, it plummeted 962.39 points or 1.17 per cent to 80,726.06.

The NSE Nifty slumped 218.85 points or 0.87 per cent to end at 24,795.75.

From the 30 Sensex firms, Adani Ports & Special Economic Zones, NTPC, State Bank of India, PowerGrid, IndusInd Bank, Axis Bank, HDFC Bank, Titan and UltraTech Cement were the major laggards.

Mahindra & Mahindra, ITC, Bharti Airtel, Infosys, Bajaj Finance, Tata Consultancy Services and Tech Mahindra defied the trend.

“The Indian markets have entered a consolidation phase with high risk of underperforming to Asian peers.

“This phase is marked by significant corrections in the broader market due to premium valuations. There is notable global arbitrage activity, with Chinese markets attracting substantial inflows driven by its attractive valuations and stimulus measures,” Vinod Nair, Head of Research at Geojit Financial Services, said.

Market capitalisation of BSE-listed companies dropped by Rs 8.90 lakh crore to Rs 4,51,99,444.70 (USD 5.38 trillion)

The BSE midcap gauge dropped 1.85 per cent and smallcap index plummeted 3.27 per cent.

Sector-wise, utilities tanked by 3.63 per cent, while power went down 3.14 per cent, and services slid by 3.12 per cent. Commodities fell 2.54 per cent, while telecommunication declined by 2.49 per cent, energy plummeted by 2.46 per cent, and oil & gas and industrials lost 2.38 per cent each.

On the other hand, IT and teck were the only gainers.

Meanwhile, shares of Ola Electric Mobility plunged over 8 per cent to Rs 90.82 apiece on the BSE amid reports of service quality issues of its electric scooters and its CEO’s spat on social media.

However, stock of Heidelberg Cement India ended 4 per cent higher following reports that the Adani Group is in talks to acquire Indian operations of Germany’s Heidelberg Materials.

The proposed buyout of Heidelberg’s India unit will be led by billionaire Gautam Adani-led Ambuja Cements and could be worth around USD 1.2 billion (about Rs 10,000 crore), the reports added.

During the day, shares of the company rallied 17.95 per cent to hit its 52-week high of Rs 257.85 apiece on the BSE.

Traders also kept an eye on the RBI’s monetary policy to be announced on Wednesday. The reconstituted rate-setting panel of the Reserve Bank on Monday started deliberations on the next bi-monthly monetary policy amid expectations of a status quo on interest rates in view of inflationary concerns and the possibility of a flare-up in the Middle East crisis that could jack up commodity prices.

In the current context, experts feel that the RBI may not follow the US Federal Reserve, which lowered the benchmark rates by 50 basis points, and the central banks of some developed nations, which have reduced the interest rates.

“With the inflation rate at 3.65 per cent in August, falling below the 4 per cent target, there is cautious optimism despite ongoing concerns about food inflation and crude prices due to Middle East tensions.

“The favourable monsoon and the Fed’s rate cut provide the RBI with ample opportunity to adjust its policy and implement rate cuts in the foreseeable future. This is expected to support the market in the long run by providing liquidity and bolstering the economy’s growth trajectory,” Anwin Aby George, Research analyst at Geojit Financial Services, said.

Global oil benchmark Brent crude surged 2.09 per cent to USD 79.68 a barrel.

European markets were trading on a mixed note on Monday.

In Asian markets, Tokyo, Shanghai, Hong Kong and Seoul settled higher.

Wall Street ended with gains on Friday.

Investors are reassessing their portfolio positions and FIIs outflows are exacerbated. Amid escalating geopolitical tensions, the surging oil prices poses a further challenge to the domestic economy in the short-term, Nair added.

Foreign Institutional Investors (FIIs) offloaded equities worth Rs 9,896.95 crore on Friday, while Domestic Institutional Investors (DIIs) bought equities worth Rs 8,905.08 crore, according to exchange data.

On Friday, the BSE Sensex tumbled 808.65 points to settle at a three-week low of 81,688.45, while NSE Nifty slumped 235.50 points to 25,014.60.

Last week, the BSE Sensex tanked 3,883.4 points, or 4.53 per cent, and the Nifty slumped 1,164.35 points or 4.44 per cent.