New Delhi [India]: Indian stock indices opened higher Friday and hovered around lifetime highs, continuing their uptrend from the previous sessions, primarily due to a moderation in inflation in May – both in India and the United States.

At the time of filing this report, Sensex and Nifty traded a touch above their previous day’s closing. Nifty sectoral indices were mixed today. India’s annual retail inflation eased to a 12-month low of 4.75 per cent in May from 4.83 per cent in April, government data showed on Wednesday.

The retail inflation in India is in RBI’s 2-6 per cent comfort level but is above the ideal 4 per cent scenario. Inflation has been a concern for many countries, including advanced economies, but India has largely managed to steer its inflation trajectory quite well.

“In the near-term the market is likely to be range bound since there are no major triggers till the budget. Since the valuations are high, particularly in the broader market, any significant up move will invite selling from the FIIs,” said V K Vijayakumar, Chief Investment Strategist, Geojit Financial Services.

“If the market trends down DIIs and retail investors will pursue a buy on dips strategy that has worked very well in this market. Sustained flows into mutual funds, particularly through the SIP route, and the retail investor’s eager to buy any dip will keep the market resilient. Investors should now take a medium to long-term view and remain invested in the market focusing on fairly valued largecaps.”

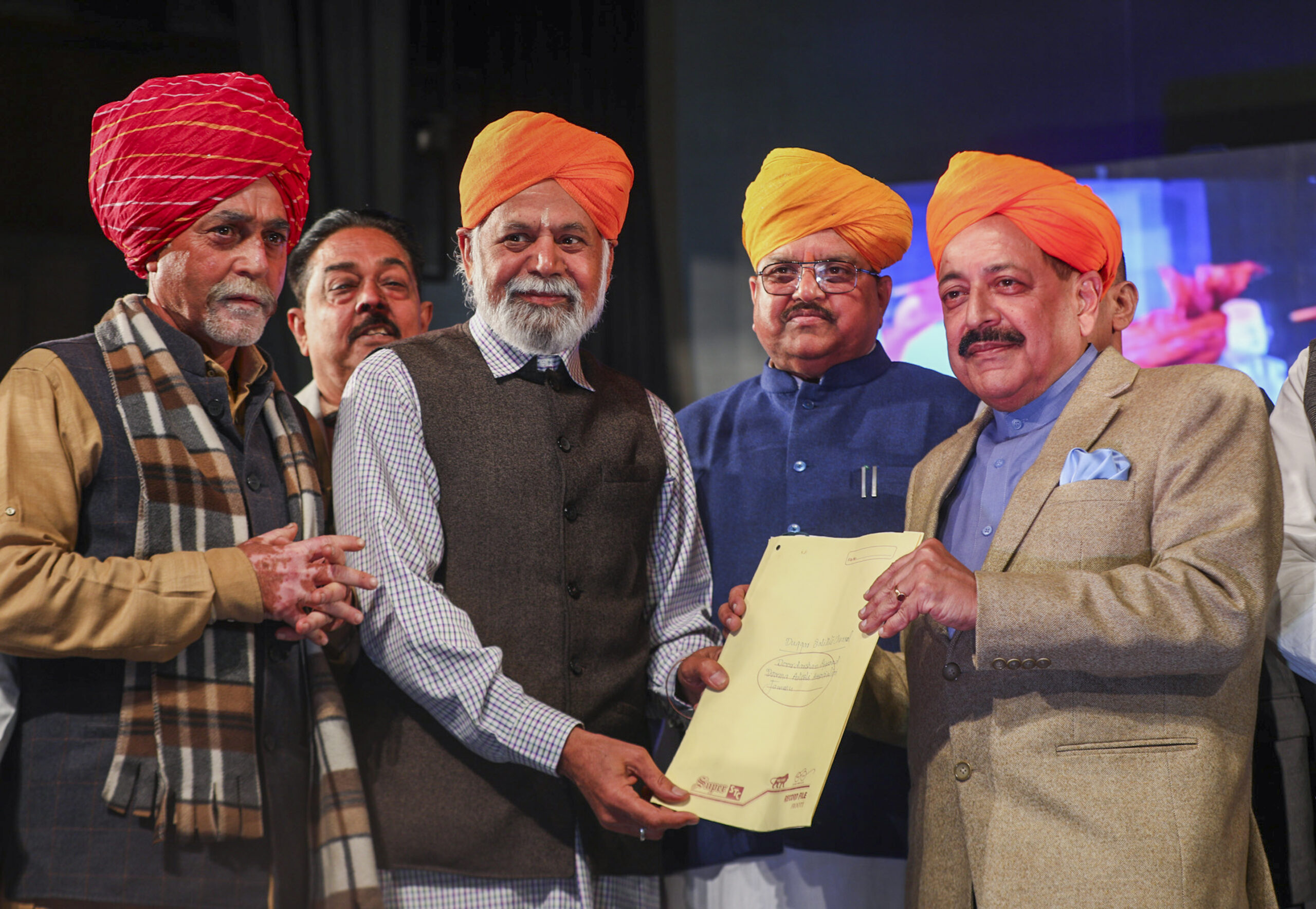

“We reiterate our recommendation to focus on stock-specific trading, particularly in themes such as agriculture-related, sugar, chemicals, and select defense stocks for long positions,” said Ajit Mishra – SVP, Research, Religare Broking Ltd. Going ahead, market participants will actively monitor the policy decisions of the new government. Nirmala Sitharaman, who has been again allocated the finance ministry portfolio, and her fresh decisions will be widely tracked. She will soon present the full Budget for 2024-25.

Indian stocks have recovered handsomely after having witnessed a bloodbath on the day the Lok Sabha results were announced, where incumbent BJP performed below par and seemed it would fall short of exit poll predictions and the majority mark on its own. The national democratic alliance (NDA) though managed to get a comfortable majority, eventually.

Many investors booked their profits they accumulated from the gains they made a day after the exit poll predictions indicated comfortable majority for BJP. All of the losses incurred on June 4 have been recovered over the next few sessions and the indices are again at their record highs. A smooth transition in the government formation seemed to have boosted market sentiments.